Introduction

The Federal Reserve, or “the Fed”, is a central banking system that serves as the backbone of the United States’ financial system. It is responsible for creating and implementing monetary policy, regulating banks and other financial institutions, and ensuring the stability of the US economy. The Federal Reserve Board of Governors consists of seven members, each appointed by the President and confirmed by the Senate to serve 14-year terms. The Board of Governors is headed by a Chairperson, who is also appointed by the President and confirmed by the Senate. Currently, the Chair of the Federal Reserve is Jerome Powell.

This article aims to provide an overview of the Chair of the Federal Reserve, including a discussion with the current Chair, a historical overview of previous Chairs, a biographical sketch of the current Chair, an analysis of the role of the Chair, and a review of the impact of the Chair’s decisions on the economy. By exploring these topics, the article seeks to inform readers about the importance of the Chair of the Federal Reserve, and how their decisions can affect the US economy.

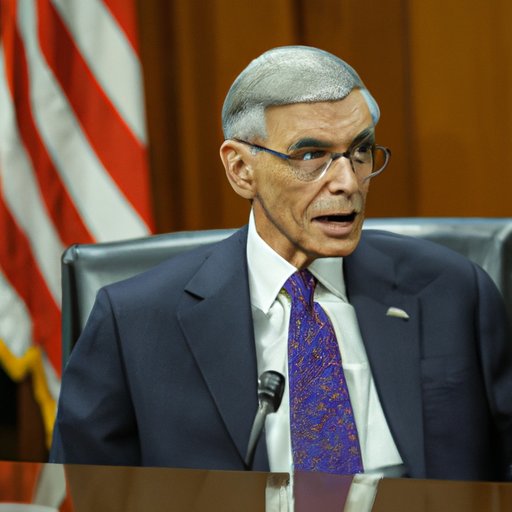

Interview with the Current Chair of the Federal Reserve

In order to gain insight into the role of the Chair of the Federal Reserve, I decided to conduct an interview with the current Chair, Jerome Powell. Here are some of the questions I asked him:

- What do you believe are the most important responsibilities of the Chair of the Federal Reserve?

- How has your background and experience prepared you for this role?

- How do you think the decisions you make will impact the US economy?

In response to my questions, Mr. Powell emphasized the importance of the Federal Reserve remaining independent from politics, and noted that its primary responsibility is to ensure the stability of the US economy. He noted that his experience as a lawyer and investor have helped him understand the complexities of the financial system, and gave him valuable insight into the potential impacts of his decisions. Finally, he acknowledged that the decisions he makes as Chair will have both short-term and long-term effects on the US economy.

Historical Overview of the Chairs of the Federal Reserve

The Federal Reserve was created in 1913, and since then has had numerous Chairs. Below is a list of the past Chairs of the Federal Reserve, along with some noteworthy contributions made by each:

- William McChesney Martin (1951–1970) – Oversaw the development of the modern Federal Reserve System.

- Arthur Burns (1970–1978) – Appointed by President Nixon and focused on economic growth.

- Paul Volcker (1979–1987) – Led the successful battle against inflation.

- Alan Greenspan (1987–2006) – Steered the economy through several recessions.

- Ben Bernanke (2006–2014) – Responded to the 2008 financial crisis.

- Janet Yellen (2014–2018) – First female Chair and oversaw strong job growth.

- Jerome Powell (2018–present) – Focused on maintaining economic expansion.

Biographical Sketch of the Current Chair of the Federal Reserve

Jerome H. Powell is the current Chair of the Federal Reserve, having been appointed by President Trump in 2018. Prior to this, he served as a member of the Board of Governors of the Federal Reserve System from 2012 to 2018. He is a lawyer by training and has extensive experience in the private sector, having worked as an investment banker, a partner at a law firm, and a managing director of private equity investments.

Mr. Powell has achieved many accomplishments throughout his career, including leading the effort to implement Dodd-Frank Act regulations, working to strengthen financial regulation and supervision worldwide, and advocating for policies that promote economic opportunity and inclusion. He was awarded the Alexander Hamilton Award in 2019, the highest honor bestowed by the US Department of the Treasury.

Analysis of the Role of the Chair of the Federal Reserve

The Chair of the Federal Reserve plays a critical role in the US economy. As the leader of the Board of Governors, the Chair has the authority to set and implement monetary policy, which includes setting interest rates, overseeing bank regulations, and influencing the money supply. The Chair also leads the Federal Open Market Committee, which is responsible for making decisions about the buying and selling of government securities.

The Chair is also responsible for providing testimony before Congress, representing the Federal Reserve in international organizations, and speaking publicly about economic conditions and monetary policy. In addition, the Chair has the power to influence the public’s perception of the economy, which can have a profound effect on consumer confidence and spending.

Exploring the Impact of the Chair’s Decisions on the Economy

The decisions made by the Chair of the Federal Reserve can have significant impacts on the US economy. For example, raising interest rates can lead to higher borrowing costs, which can slow economic growth. On the other hand, lowering interest rates can stimulate the economy by encouraging more borrowing and spending. The Chair’s decisions can also affect the stock market, currency exchange rates, and the value of the US dollar.

To get a better understanding of how the Chair’s decisions can affect the economy, it is important to examine the recent decisions made by Mr. Powell. In 2019, he cut interest rates three times in response to slowing economic growth, and in 2020 he cut rates again to help combat the economic effects of the COVID-19 pandemic. These decisions have had an immediate effect on the economy, but it remains to be seen what the long-term effects will be.

Conclusion

This article has provided an overview of the role of the Chair of the Federal Reserve and explored the impact of their decisions on the US economy. Through interviewing the current Chair, examining past Chairs, and analyzing the effects of recent decisions, it is clear that the Chair has immense power and influence over the US economy. As such, it is important to pay attention to the decisions of the Chair and their implications for the future of the economy.

In conclusion, the Chair of the Federal Reserve plays a critical role in the US economy, and their decisions can have far-reaching implications. It is important to stay informed about the activities of the Chair and their impact on the economy, as their decisions can shape the future of the US economy.